Buckets

This should be pretty obvious, but:

VCs should be giving different advice to different companies.

But we’re seeing many VCs give the exact same advice to each company in their portfolio: “everything is bad, cut everything now.” It turns out some companies should do that, but not all. And great companies are starting to be given bad advice.

Plus, VCs are giving founders whiplash. Just a few months ago, VCs were giving the advice that growth traded at a premium, and they advised companies on their 2022 budgets under the following assumptions:

At a minimum growth rate, any company could raise a round at any price

Equity markets would continue to look strong

This was despite things really starting to slow down around Thanksgiving.

And now, those same VCs are telling their portfolio companies to universally cut costs, extend runway, and raise capital. But not all companies should be doing the exact same thing.

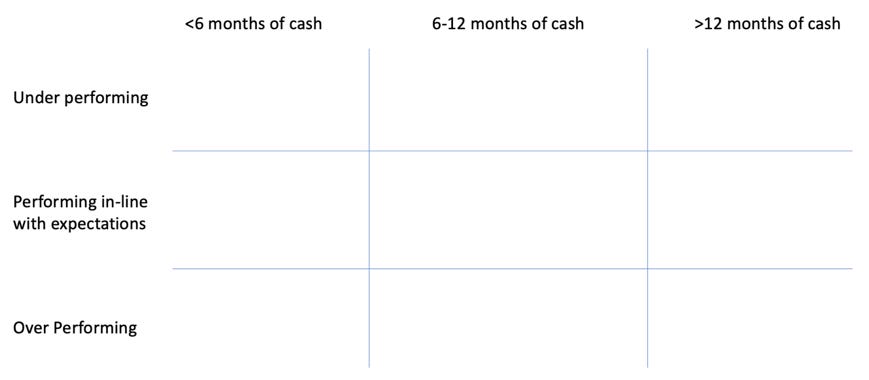

We more or less look at companies across the following buckets (one of my first partners, Thatcher Bell, always forced us to start our portfolio meetings by looking at our companies through this lens):

Obviously, the advice based on the situation varies. But for companies towards the bottom right, life has gotten easier to navigate. Hiring has gotten easier, there will be less pricing pressure from competition, spending money on paid acquisition might get more affordable, etc.

Our general advice to those companies has been as follows:

Time went from being against you, to being on your side. There’s no need to rush to do anything. Slow down. This isn’t going to be a two month cycle and while it will eventually be time to play offense, that time doesn’t need to be right now. Especially while markets and sentiment is so volatile.

Simplify the business. When you’re over funded, and doing well – it’s hard to say no to employees who want raises, or to buy new software tools, or who want to try building out a new project. This is a good time to re-set focus, and culture of frugality.

Don’t let a crisis go to waste. This is a good time to identify under performers and upgrade talent as it gets easier to hire.

Strategic acquisitions may come, but could take a while. The first things ready to sell will be the weakest deals in the market. The better deals will start to come over the next 6-18 months.

I spoke with one of our founders yesterday who has a business that’s growing fast, has great margins, a sober CEO, and tons of cash. His other VCs are encouraging him to raise money right now despite having lots of runway. I couldn’t really figure out why. Why not wait 3-4 months when things calm down? Why not use right now to upgrade talent, and re-focus the business away from any science experiments being run? I think for the companies who are operating from a position of strength it’s a good chance to take a deep breadth, slow down, and ignore the noise for a bit. It’ll be easier to think more clearly in a month or two.

For companies near the top left of our bucket diagram – things have obviously gotten a lot more challenging. And, unfortunately, many founders in the top left box first will go into a state of denial (which is not very surprising). They have been building their businesses with the backing of reputable VCs who have been validating their idea. And while the idea is really compelling, the product-market fit just isn’t there yet.

For a lot of these companies, they do not have a path to controlling their own destiny within 1-2 rounds, they have not shown product-market fit, and they are unlikely to receive new financing until they have.

Our advice here has been to take whatever measures are possible to extend runway to give founders the best opportunity to either eventually control their own destiny, or find product-market fit over a 24 month period. And if there is an opportunity to sell, they should seriously consider doing so.

The advice obviously gets most nuanced for the businesses in the middle. Our general advice to those companies has been:

Investors used to put a premium on growth. Now they put a premium on self-sustainability. Try to build a new operating plan that can get you to cashflow breakeven within 1-2 rounds

Speak with your VCs ASAP about their capability to continue providing insider rounds (to understand not just how much cash is on your BS, but also how much dry powder is on your existing cap table).

If there is dry powder on your cap table, focus on execution, simplify the business, and cut out anything other than a focus on your core product and sustainability.

If there is an ability to cut budget without sacrificing the focus on your core product, it may be a good time to do that.

For these businesses, making hard decisions will be hardest, because it may not feel like they need to. They’ve been hitting their plan, and their VCs have been encouraging growth, product extension, and a path to becoming an over-performer.

But in the hierarchy of priorities, I’d first make sure being self-sustaining is an option your investors believe in, and only once that feels achievable would I focus on offense again.

And finally, for all companies, we’ve told them to ignore whatever their last valuation was, or what expectations they had previously had. Even we don’t know where things will re-calibrate to. But trying to peg the next financing to a valuation might put your next capital raise at risk. It’s time to have low-to-no ego, and ensure liquidity and survival above all else. Expect the worst, hope for the best. But don’t blow up a fundraise by asking for too much at too high of a price.

In any case, each company is different. Some should be given the advice that they need to take dramatic action quickly. But many are doing very well – and VCs should start showing a bit more nuance in their guidance.

—

If you enjoyed this post, we’d love for you to subscribe/share it with others:

—

This is a personal blog collaboration. All views and opinions expressed are those of the authors and do not reflect the views or opinions of any organizations the authors may be affiliated with. This website and the information contained herein is not intended to be a source of advice with respect to the material presented, and the information contained in this website does not constitute investment, tax, or legal advice. We make no representations as to the accuracy, completeness, correctness, suitability, or validity of any information on this site.